The

loan platform for business owners.

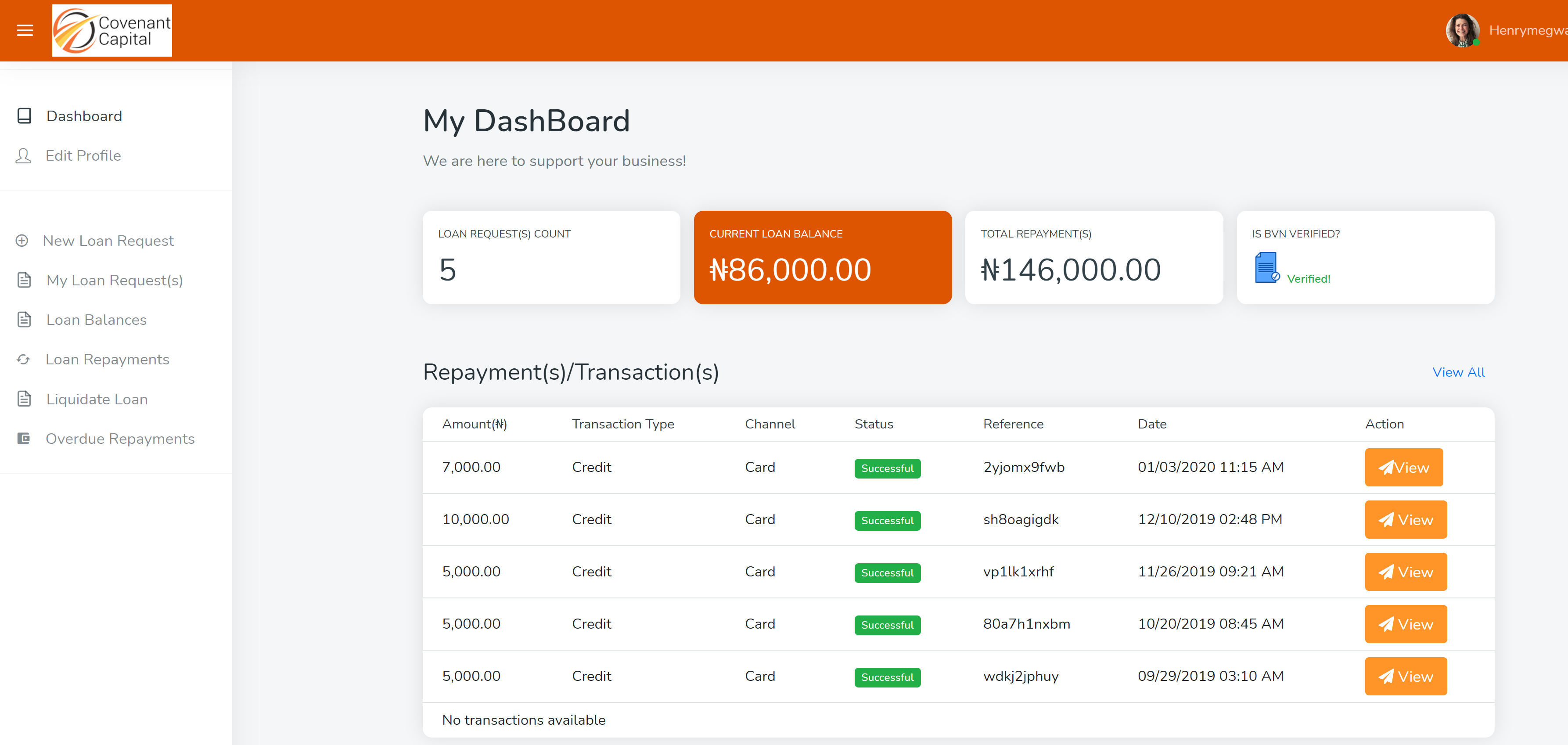

Covenant Capital Loan is an interest free, no collateral loan disbursement platforn targeted towards business owners within the The Covenant Nation.

Driving

Impact

My own church gave me non-interest loan a few years ago. Lol. Shut out to Covenant Capital..

Tunde Ademuyiwa

Founder - KiakiaprintWhy CovCap Loan?

As a business owner, with CovCap loan, you can cover the expenses of expanding your business without eating your operational funds, so that you can continue to impress customers while growing your business

NanoCredit Loans

This comprises of loans within the range of N10,000 (ten thousand Naira) to N50,000.00 (fifty thousand Naira) .

MicroCredit Loans

This comprises of loans within the range of N100,000.00 (One Hundred Thousand naira) to N500,000.00 (Five Hundred Thousand Naira) are available on interest-free for business purposes.

Support your business with CovCap Loan

Yes! Interest-free and no administrative charges.

Terms & Conditions.

The following terms and conditions apply:

Applicant must be a member of The Covenant Nation (TCN), for at least six (6) months

Must have an existing business and a viable business opportunity to which the funds

will be applied, business purposes only

Submission of a copy of applicant’s valid means of identification

(i.e. International Passport, Permanent Voter’s Card, National Identification Card, Drivers’ License)

Submit Applicant’s Six (6) months Bank Statement, Savings or

Current account with a recognized Commercial or Microfinance Bank in Nigeria.

Applicant to submit One (1) passport photograph

Applicant to submit Utility Bill (PHCN, LWC, Bill, LAWMA e.t.c.)

A well-articulated Business case Summary.

Two (2) completed guarantors’ form for loans of N100,000 to N500,000.00

One (1) completed guarantor’s form for loans of N50,000 or less.

Submit Guarantors’ Six (6) month’s Bank Statement showing repayment capacity and healthy cashflow; for loans of N100,000 to N500,000

Submit Guarantors’ three (3) month’s Bank Statement showing repayment capacity and healthy cashflow; for loans of N50,000 or less.

Submit a copy of Guarantors’ Valid means of Identification and Utility bill.

Guarantor(s) to submit One (1) passport photograph

In exceptional cases, a Guarantor may be required in the person of a Cell leader, Unit Head, or Minister in The Covenant Nation to guarantee the loan, assuming responsibility for any default.

Simple Repayment Terms At No Interest Rates

.

With CovCap Loans there are no hidden charges, our repayment terms are clear and convenient for you, do enable you focus on yout business growth.